A company estimates an. The annuity method of.

Depreciation Methods 4 Types Of Depreciation You Must Know

Per unit Cost Scrap valueTotal estimated unit of.

. I have following questions. In 2012 this is 10100 units so depreciation expense is 4545 10100 x 045. Answer 1 of 16.

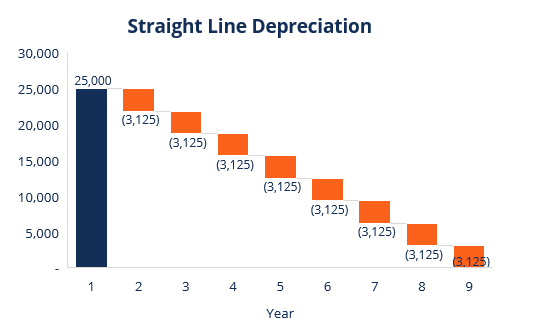

Under this method we deduct a fixed. Written Down Value or Fixed Percentage on Diminishing Balance or Reducing Installment Method. Straight-line depreciation is the most simple and commonly used depreciation method.

Straight-Line Depreciation The straight-line method charges the same amount of depreciation to expense in every reporting period. Annual depreciation will be the quantity extracted multiplied by the rate per unit. The formula for finding depreciation using straight line method is given below.

The written down value method also known as diminishing balance method or reducing balance. Straight-line depreciation is the most simple and commonly used depreciation method. 2 x 010 x 10000 2000.

Expense per hour x No. The straight-line method is the most common and simplest to use. Reducing balance depreciation method.

Depreciation Methods 4 Types of Depreciation Formula Calculation 1. So the equation for year two looks like. Now the book value of the bouncy castle is 8000.

Methods of Depreciation and How to Calculate Depreciation Fixed Installment or Equal Installment or Original Cost or Straight line Method. Under this method the following is calculated. Sum of the Digits Method.

Over time the asset value will decrease due to usage wear and tear or obsolescence. Methods of Depreciation Straight-Line Depreciation. The declining balance method is a type of accelerated depreciation used to write off.

Explain different types of depreciation methods with illustrative examples. In 2013 actual units are 15300. Various Depreciation Methods Straight Line Depreciation Method Diminishing Balance Method Sum of Years Digits Method Double Declining Balance Method Sinking Fund Method Annuity Method Insurance Policy Method Discounted Cash Flow Method Use Based.

Diminishing balance or Written down value or Reducing balance Method. Depreciable amount is the same irrespective of the choice of depreciation method. Various methods are used by the companies to calculate depreciation.

The depreciation formula is Depreciation Expense Cost Salvage Value Useful Life 2. Machinery Equipment Currency are some examples of assets that are likely to depreciate over a specific period of time. This decrease is measured as depreciation.

Double Declining Balance Depreciation Method. Of all the depreciation calculation methods that are assigned to depreciation key in AFAMA does only one act at any point in time to determine the depreciation or do multiple calculation methods act together to determine the depreciation. Depreciation - The monetary value of an assets decreases over time due to use wear and tear or obsolescence.

As the name suggested the earlier period shows higher. The depreciation calculations are done as follows. There are several methods of depreciation which can result in differing charges to expense in any given reporting period.

Of units produced during the year. Straight Line The straight line method involves determining the cost to depreciate and dividing that amount by the number of years the company expects to use the asset. Provision for depreciation is on a TIME BASIS ie.

Depreciation is the process of spreading or allocating the cost of an asset over its useful life. Very good information. Now work through one more year.

Reducing balance depreciation changes the amount of depreciation charged over time. It is the simplest method of depreciation. Under this method we charge a fixed percentage.

For example If a mine has 2 lakh tons of coal and the value of mine is 5 lakhs each ton of coal will cost 250. 500000 cost - 10000 salvage 490000 1 2 3 4 5 6 7 8 9 10 55 Remaining life of year one is ten. Youll write off 2000 of the bouncy castles value in year one.

Straight-Line Method In case of straight-line depreciation calculation the amount of expense is the same for each year of the asset lifespan. For 2013 through 2016 the same calculation applies. The following are the various methods for providing depreciation.

Thats why there are many depreciation methods. Of hours used during the year. What are the different types of depreciation.

The following are the general methods of depreciation available for use. Impact of using different depreciation methods The total amount of depreciation charged over an assets entire useful life ie. Units of Production Method.

Thus RMDY 1055 01818 First years depreciation is 01818 X 490000 89090 Second years depreciation is 955 016363 X 490000 80181. In other words why do we have to assign multiple depreciation. To compute depreciation expense year after year you multiply the actual number of units the machine makes during the year by the depreciation rate.

The four main depreciation methods Straight-line depreciation method. Expense Per unit x No. Different companies may use different types of depreciation methods especially those in different industries.

Common methods of depreciation are as follows. These are as follows. 2 x 010 x 8000 1600.

2 x straight-line depreciation rate x book value at the beginning of the year. The depreciation rate is calculated by dividing the cost of the asset by the estimated quantity of product likely to be available. The original cost of the physical assets is taken into consideration in the course of calculating depreciation.

The straight-line method of depreciation is the most simple and easy to use depreciation method. In this method depreciation expense. Depreciation Per annum Dep.

No depreciation is charged in the year of purchase but a FULL years depreciation in the year of disposal. Straight Line or Fixed Percentage on Original Cost or Fixed Installment Method. Written Down Value Method.

No depreciation is charged in the year that the assets were disposed of irrespective of how many months they were in use. One months ownership needs one months provision. The types of depreciation calculation owing to its methods are indicated below.

The advantage of using the straight line method involves the ease of calculating the annual depreciation amount. Annual depreciation D Original cost Scrap value Life in year C S n Where C original cost S scrape value n life of property in years D annual depreciation.

Depreciation Methods 4 Types Of Depreciation You Must Know

Depreciation Formula Calculate Depreciation Expense

Depreciation Definition Types Of Its Methods With Impact On Net Income

0 Comments